What exactly is Mobile Cheque Deposit?

Blogs

GOBankingRates works together of many financial entrepreneurs in order to reveal items and you may services to our viewers. These types of brands make up me to promote items inside advertisements around the our very own web site. So it settlement get feeling exactly how and you can where issues appear on so it website. We are really not an assessment-tool that also offers do not portray all the offered deposit, investment, mortgage otherwise borrowing issues. No-deposit bonus rules are geared towards the fresh professionals, but some web based casinos as well as hand out no-deposit presents to current profiles as an element of added bonus apps.

Your commit to retain the Goods within the a safe and you can safer ecosystem for example day in the date from put acknowledgement (« Preservation Period »). Through to demand of Lender otherwise Merrill, you are going to timely provide the Items to Financial otherwise Merrill while in the the new Maintenance Period. After the newest Retention Period, you commit to damage the item in the a safe fashion.

With your insider tips, your mobile view deposits will experience smoothly initially. That will give you with an increase of sparetime for your favourite activities rather than riding on the Automatic teller machine or the lender department. You might question who are able to get access to the fresh painful and sensitive guidance exhibited for the a check, however, view images aren’t kept on your cellular phone. As opposed to taking a for the financial, cellular view put makes you breeze photos of your front side and you will right back away from a check, publish them to an app and you may deposit the brand new consider electronically.

- Whenever researching offers, excite opinion the lending company’s Small print.

- These transaction and lets users to store greatest song of the investing if you are still enjoying on the web enjoyment.

- You could take a look at photographs from previous monitors your’ve transferred to the application.

- Merely breeze a graphic of your consider and you can stick to the easy encourages in order to put it.

- With respect to the financial, finance placed via mobile look at put can be offered as soon because the following day.

- In the event the something happens to your mobile view put, you may have to put the brand new paper view instead.

Confirmation out of a mobile deposit isn’t a vow so it obtained’t getting came back. Should your cheque bounces as the person who composed they doesn’t have enough money inside their membership to fund they, the cellular put would be reversed. That’s since the cellular cheque deposit feature inside programs fundamentally also offers a user-friendly sense, even for lowest-tech people. When you can functions the digital camera on the cellular telephone or pill and also you know how to obtain a software, then you can fool around with mobile cheque deposit. Notice people type of cheques the bank excludes out of deposit due to cellular financial.

How to Deposit A check To the A Financial institutions Mobile Software?

Such answers mrbetlogin.com favorable link aren’t given otherwise commissioned by bank advertiser. Answers have not been examined, accepted or else recommended by bank advertiser. This is not the bank marketer’s responsibility to make sure all the listings and/otherwise inquiries are answered.

Promote Your Dated Cellular phone

Contrast the organization examining alternatives and get the proper family savings to you. The main difference in demand put against. term deposit membership is how without difficulty you can access your bank account. Whilst you is also withdraw out of a request deposit membership sometimes instantly or in a few days, identity deposit account are created to hold your bank account for an excellent particular time. Whilst you may be able to withdraw from your own deals or money field membership each time, the bank get limitation the amount of distributions monthly. Prisoners may use funds from the membership to buy cellular phone go out loans or prepaid international calling cards to create additional mobile phone phone calls so you can family and friends participants. Speak to your financial to see if it has which free, automatic function.

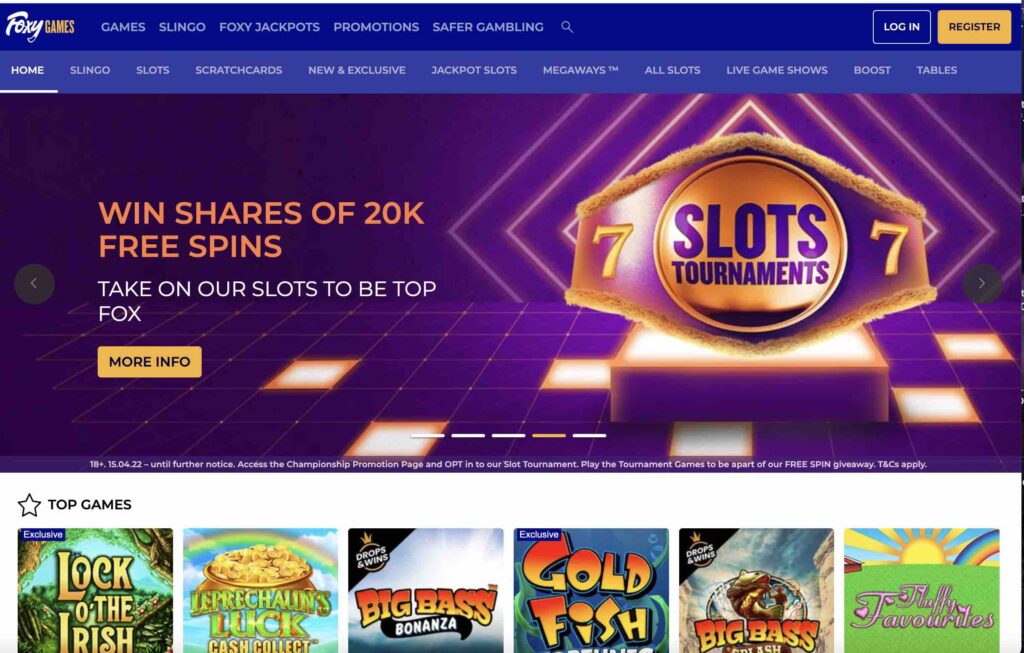

The brand new Betting Percentage’s on the web tracker questionnaire within the 2021 signifies that 60% away from on the internet gamblers have tried a mobile phone so you can gamble to the. Jackpot.com allows you to deposit using your mobile phone on the Boku percentage approach. Having a minimum deposit away from £10, look at the Deposit point and select Boku. After you confirm the deposit thru Sms, your own finance will be for sale in your account instantly.

You’re Today Making Chase

To transmit currency for delivery one to will come normally within minutes, a great TD Financial Visa Debit Credit becomes necessary. Message and you may investigation cost will get pertain, speak to your cordless supplier. Mobile cheque deposit is going to be a handy means to fix deal with dumps so you can an excellent chequing, offers otherwise currency industry membership.

Learn the criteria and tips for how to open up a verifying membership due to the book. Committed it will take to do an internet put may vary because of the financial. Such as, if you make a deposit to the Saturday, the new put will be credited to your account to your Saturday and you may available on Friday. Branch, Automatic teller machine and you will Cellular dumps try at the mercy of comment and you may money from your deposit may not be available for immediate detachment.

With Chase otherwise Bank out of America direct deposit, among most other banks’, may also be helpful you prevent month-to-month savings account charges. Customers with many different bank account maintaining huge balance would be eligible for high mobile deposit limitations. The good news is, of a lot online banking companies appreciate this question and offer high mobile deposit limitations compared to the financial institutions that have a physical exposure. The brand new Wells Fargo mobile look at deposit restrict for everybody consumers is actually $2,five-hundred per day and $5,100 more thirty day period. The brand new Pursue mobile take a look at deposit restrict for all customers is actually $2,100 each day and you may $5,000 more than 1 month. When you are a business banking buyers, see Secluded Deposit On the internet connect from the Team Characteristics routing selection.